Scale Acquisitions is a premier consulting firm specializing in capital sourcing, off-market acquisitions, deal flow consulting, and advisory services. We work with investment funds, private equity, and companies looking to expand their portfolios or raise capital without the hassle of having to generate more investor leads or potential acquisition targets. Our team of experienced professionals has a proven track record of success in helping clients navigate the complex and competitive world of off-market acquisitions and investment opportunities.

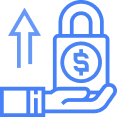

We understand that finding the right deals and sourcing investors is one of the main keys to success for investment funds & firms. That’s why we offer the perfect services to help our clients with Done-for-you sourcing. Whether its finding more investors or ideal assets to acquire, Scale Acquisitions has you covered.

We integrate our industry-leading deal flow system into your fund or firm to unlock and consistently deliver ideal acquisition and investment opportunities that are exclusive to you. We become your fractional deal flow team.

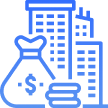

Looking to raise capital? Scale Acquisitions sources investors at a high volume that are interested in deploying capital into your fund. All you have to do is just show up to meetings with Investors!

Don’t see your industry here? Let’s talk!

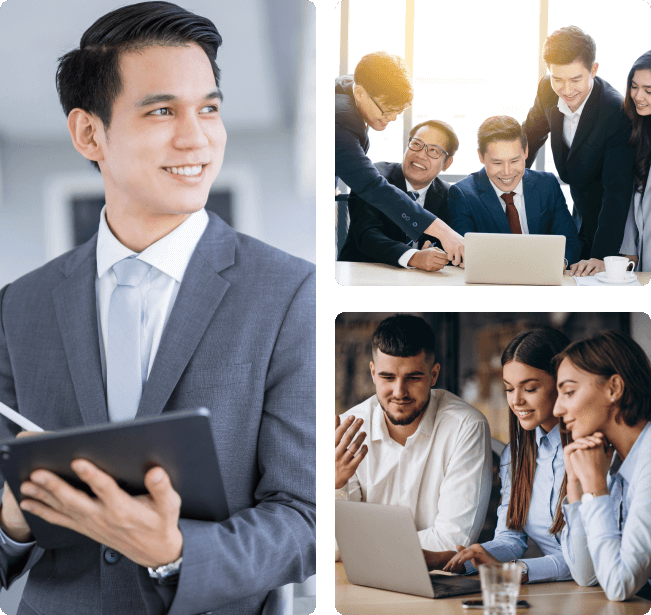

Patrick VanDusen is the Founder & Managing Partner of Scale Acquisitions. With a robust track record as a serial entrepreneur, Patrick has successfully launched and managed ventures across a diverse range of industries. His extensive experience as an investor and advisor has enabled him to identify and nurture promising opportunities, driving substantial returns for stakeholders.

Beyond his entrepreneurial and investment endeavors, Patrick is a self-professed marketing nerd. His deep passion for marketing is evident in his innovative approaches and cutting-edge strategies that have consistently delivered outstanding results. Patrick’s unique blend of business acumen, creative marketing insights, and strategic vision positions him as a leading figure in the world of private equity and investing.

Founder of The Accelerator Fund

Copyright © 2026 Scale Acquisitions LLC. All Rights Reserved.